Kenya Livestock Insurance Program (KLIP) [Kenya]

- Creation:

- Update:

- Compiler: Duncan Collins Khalai

- Editor: –

- Reviewers: Hanspeter Liniger, Donia Mühlematter, Rima Mekdaschi Studer, Barbara *, Joana Eichenberger

KLIP

approaches_3283 - Kenya

- Full summary as PDF

- Full summary as PDF for print

- Full summary in the browser

- Full summary (unformatted)

- Kenya Livestock Insurance Program (KLIP): Nov. 2, 2021 (public)

- Kenya Livestock Insurance Program (KLIP): July 12, 2018 (inactive)

- Kenya Livestock Insurance Program (KLIP): Sept. 3, 2018 (inactive)

- Kenya Livestock Insurance Program (KLIP): June 7, 2018 (inactive)

- Kenya Livestock Insurance Program (KLIP): May 23, 2018 (inactive)

- Kenya Livestock Insurance Program (KLIP): May 13, 2018 (inactive)

- Kenya Livestock Insurance Program (KLIP): Feb. 27, 2018 (inactive)

- Kenya Livestock Insurance Program (KLIP): Feb. 26, 2018 (inactive)

- Kenya Livestock Insurance Program (KLIP): Jan. 14, 2018 (inactive)

View sections

Expand all Collapse all1. General information

1.2 Contact details of resource persons and institutions involved in the assessment and documentation of the Approach

Name of project which facilitated the documentation/ evaluation of the Approach (if relevant)

Index Based Livestock Insurance, Kenya (IBLI)Name of project which facilitated the documentation/ evaluation of the Approach (if relevant)

Book project: Guidelines to Rangeland Management in Sub-Saharan Africa (Rangeland Management)Name of the institution(s) which facilitated the documentation/ evaluation of the Approach (if relevant)

ILRI International Livestock Research Institute (ILRI) - Kenya1.3 Conditions regarding the use of data documented through WOCAT

When were the data compiled (in the field)?

23/11/2017

The compiler and key resource person(s) accept the conditions regarding the use of data documented through WOCAT:

Yes

2. Description of the SLM Approach

2.1 Short description of the Approach

Government of Kenya (GoK) is implementing the Kenya Livestock Insurance Program (KLIP). KLIP is a GoK funded drought insurance program for vulnerable pastoralists located in the Arid and Semi-Arid Lands (ASALs) of Kenya. KLIP’s overall objective is to reduce the risk of livestock mortality emanating from drought. This is intended to help to build resilience of vulnerable pastoralists for enhanced and sustainable food security.

2.2 Detailed description of the Approach

Detailed description of the Approach:

Currently, under KLIP, GoK pays insurance premiums for a maximum of 5 Tropical Livestock Units to over 18,000 selected households that are considered vulnerable (i.e. own less than 5 TLUs). (0.1 of 1TLU is equivalent to 1 goat or sheep,therefore 10 goats/sheep = 1 cow (TLU) and 1.7 of TLU is equivalent to a camel or 17 goat/sheep or 1 cow + 7 goats/sheep = 1 camel). The program is currently being implemented in 8 Arid and Semi-Arid counties in Northern Kenya. In case of severe forage scarcity because of drought, the households enrolled on KLIP receive pay-outs to enable them purchase fodder, veterinary drugs and water to keep their animals alive during the drought season. The expected impact of KLIP on pastoralists’ livelihoods protected assets and improved resilience due to better recovery mechanisms from drought shocks. At national level, reduced expenditure on humanitarian emergencies during severe droughts and sustained contribution of the livestock sub sector to the national economy is expected. As a Sustainable Land Management (SLM) solution, the KLIP approach can contribute to reduced pressure on grazing lands by providing pay-outs which are used by pastoralists to purchase animal feeds from outside the KLIP counties during drought periods, leading to reduced land degradation.

KLIP was first piloted in 2014 in 2 counties in the ASALs of Kenya i.e. Wajir and Turkana counties. 2500 households from each county were enrolled to the program, each receiving insurance worth 5TLUs for 1-year renewable period. In August 2016, 275 households in Wajir County received a total of Ksh. 3.5 million pay-out as a result of the failed long rain season of the same year. KLIP later expanded to cover 4 more counties in 2017 which included Isiolo, Marsabit, Mandera and Turkana raising the total number of beneficiary households to 14,000. In February 2017, a payout worth Ksh. 214 million was triggered to 10,000 pastoralists households across the six counties at the end of the failed short rainy season of 2016 (October to December). In 2017 KLIP added to more Counties Samburu and Tana River on its scope. Later in August of the same year, another payout worth Ksh. 319 million triggered across 7 counties leading to 12,000 beneficiaries receiving compensation. Currently KLIP is operational in the 8 counties, with plans underway for expansion to reach all the 14 ASAL counties of Kenya.

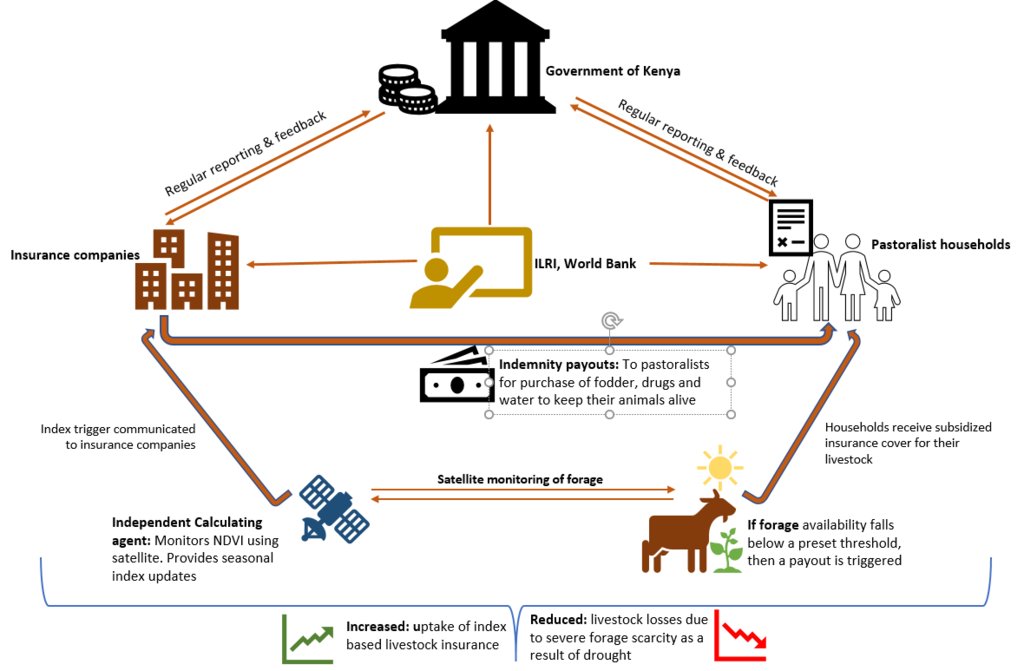

KLIP pay-outs are pegged to measurements of forage conditions made via satellite data on vegetation cover to derive an index of seasonal forage availability/scarcity, called the Normalized Differenced Vegetative Index (NDVI). The index can be defined as a measure comparing the total amount of forage available across the contract season with the historic average forage availability of that season. When the index signals that forage conditions have deteriorated to the point that animals are likely to die, KLIP compensates pastoralists in cash pay-outs immediately after a failed rainy season(s) and just before the start of subsequent dry season to help pastoralists buy fodder, drugs and water to sustain their livestock through the drought period.

The use of a satellite based Index eliminates the need for insurance companies to carryout loss verification, which would be logistically and financially impossible to implement if they were to provide livestock insurance in such vast and remote areas as Kenya’s ASALs. Satellite data (NDVI) is used to calculate forage conditions in a specific area over a specific season in order to determine whether the index could trigger a pay-out. Once pay-outs are triggered pastoralists registered under the affected areas are automatically eligible for compensation . Payouts are immediately disbursed via either M-Pesa or bank accounts depending on the beneficiaries preffered means as specified during registration.

The implementation of KLIP is done through a Public Private Partnership approach (PPP) spearheaded by the State Department of Livestock (SDL) under the Ministry of Agriculture, Livestock and Fisheries (MOALF). The GoK purchases KLIP policies on behalf of the pastoralists targeted under the KLIP program. However, in case of an insurance payout, indemnified households receive their respective share of the payout directly from the underwriting insurance company/ies. Private Insurance companies registered in Kenya provide underwriting services for KLIP. The World Bank Group provides financial and technical support while ILRI provides awareness and capacity development support together with KLIP contract design. Various capacity development and awareness creation tools e.g. radio programs, posters, flyers, cartoon booklets, videos and training manuals have been used by KLIP to target pastoralists, partners and policy makers. A contract design tool has also been developed for KLIP with the support of ILRI and the WBG for insurance firms to use in determining their KLIP pricing options.

2.3 Photos of the Approach

2.4 Videos of the Approach

Comments, short description:

This video summarizes the gains made since the launch of KLIP by the State Department of Livestock in Kenya. It describes the various roles played by partners in the Public Private Partnerships (PPP) approach used in implementing KLIP i.e. Government, Private sector and Non-governmental Institutions.

Location:

Kenya

Name of videographer:

INTERNATIONAL LIVESTOCK RESEARCH INSTITUTE

2.5 Country/ region/ locations where the Approach has been applied

Country:

Kenya

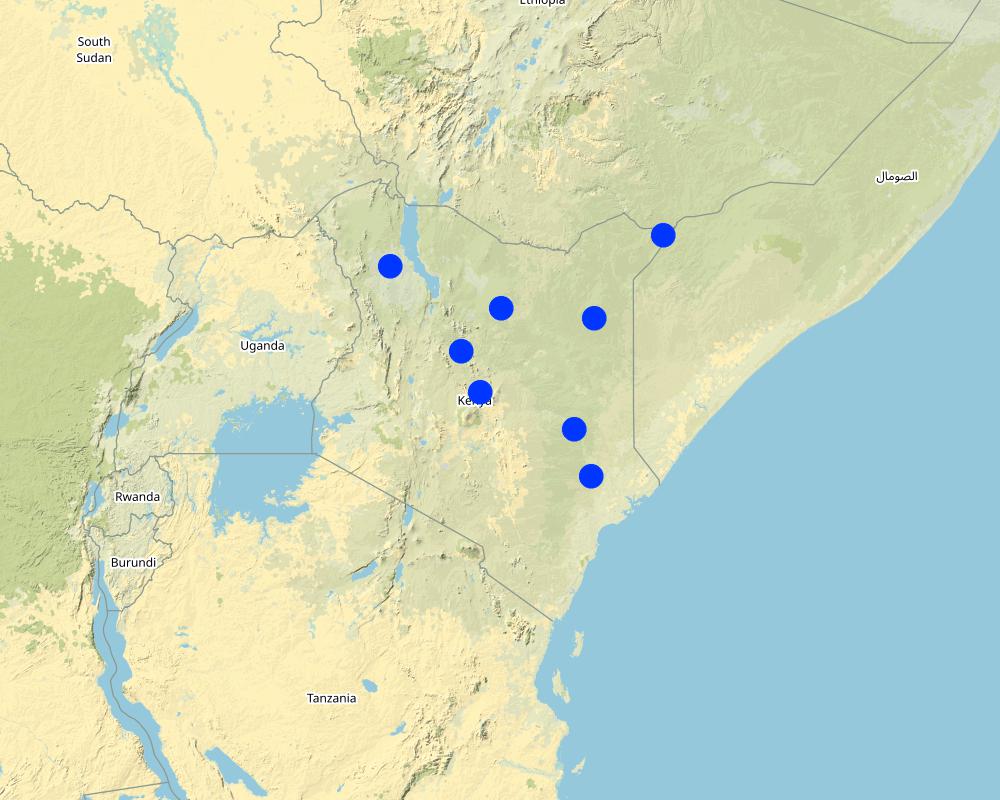

Region/ State/ Province:

Counties, Isiolo, Mandera, Wajir, Tana river, Marsabit, Turkana, Kenya, Samburu, Garissa

Further specification of location:

Counties

Comments:

GoK plans to expand KLIP to all the 14 ASAL counties of Kenya

Map

×2.6 Dates of initiation and termination of the Approach

Indicate year of initiation:

2014

If precise year is not known, indicate approximate date when the Approach was initiated:

less than 10 years ago (recently)

2.7 Type of Approach

- project/ programme based

2.8 Main aims/ objectives of the Approach

The overall objective of KLIP is to reduce the risk of livestock mortality emanating from drought and to build the resilience of vulnerable pastoralists for enhanced and sustainable food security. KLIP is intended to enhance the capacity of pastoral communities to minimize weather related risks through provision of index based livestock insurance.

KLIP's specific objectives are:

i) To build the resilience of vulnerable pastoralists in Kenya's ASALs against the consequences of drought by developing and applying index based insurance products in the provision of livestock insurance services to the pastoralists

ii) To build capacities of the pastoral communities and stakeholders in the use of insurance for the reduction of weather related risks and rebuilding of livelihood support systems;

iii) To increase Public-Private-Partnerships (PPP) in the provision of index based livestock insurance to the vulnerable pastoralists whose livelihoods are dependent on livestock.

2.9 Conditions enabling or hindering implementation of the Technology/ Technologies applied under the Approach

social/ cultural/ religious norms and values

- enabling

Apart from being the main source of livelihoods for many of the communities living in Kenya's ASALs, pastoralism is a cultural practice that has been passed on from generation to generation. Pastoralists aspire to protect their herds from all manner of perils, including drought related livestock losses.

- hindering

The belief that rainfall or drought are both God's fate upon man is common both as a traditional and religious belief among pastoralist communities. Most of them hold that human beings should not try to control/mitigate against such. There is also the concern of whether insurance is "halal" in the context of Islamic Shariah. Both of these challenges have been widely addressed in the implementation of KLIP, through awareness creation and sensitization efforts done in consultation and involvement of national and local religious leaders together with insurance companies and the local communities.

availability/ access to financial resources and services

- enabling

Financial support for KLIP mainly from GoK and the World Bank Group. This has been a great enabling factor as huge financial investment is required for premium subsidies, awareness creation, operations etc.

- hindering

Bureaucratic processes involved in the steps towards policy formulation puts at risk the guarantee for continued funding from the government of Kenya, especially in case of regime change. Efforts are being made to influence and initiate policy formulation at the national level. The SDL has also approached county governments where KLIP is being implemented to encourage them to contribute towards the scheme, in order to cover their local communities.

collaboration/ coordination of actors

- enabling

KLIP has leveraged academic research, advocacy, private sector partnerships, NGOs and other stakeholders working to improve the livelihoods in the pastoralist rangelands of Kenya. It has managed to tap into emerging innovations and insights from past work done for instance by ILRI and her partners such as AUSAID, DFID, USAID, Cornell University, European Union in the implementation of Index Based Livestock Insurance (IBLI), managing to further draw on both the knowledge generated and lessons learned (see references below).

policies

- enabling

KLIP enjoys the goodwill of various partners including the Insurance Regulatory Authority (IRA), county governments, the national treasury, National Parliament, the Presidency and other key stakeholders who are willing to support the program in policy formulation and advocacy to create an enabling environment for the scaling-up of KLIP and further commercialization of index insurance by private local insurance companies and other financial sector players.

knowledge about SLM, access to technical support

- enabling

Access to technical support by the GoK from both ILRI and the World Bank, especially for KLIP contract design and index monitoring - together with requisite capacity development and awareness creation - have enabled effective roll out and implementation.

3. Participation and roles of stakeholders involved

3.1 Stakeholders involved in the Approach and their roles

- local land users/ local communities

Pastoralists, also known as KLIP beneficiaries

Pastoralists households who are vulnerable to drought shocks are the primary beneficiaries in the implementation of KLIP. They receive timely cash payouts at the onset of drought in order to keep their livestock alive throughout the season.

- private sector

Insurance companies

Private insurance companies underwrite the KLIP product either individually or as a consortium. The underwriting insurer is expected to underwrite and distribute pay-outs whenever the index is triggered to beneficiaries listed on KLIP. The selection of the insurer is based on its capacity to underwrite the risk, develop new or strengthen existing products in line with government policy and provide livestock insurance capacity building and awareness creation services. Underwriting insurers are also in charge of marketing the product and explaining its features to (potential ) policyholders.

- local government

County governments in the target ASAL areas

The national government utilizes county governments infrastructure for the implementation of KLIP. Counties provide support to the national government in sensitization, mobilization and selection of benefiting pastoralists for the fully subsidized KLIP component. The county governments also provide support during payouts and monitoring and evaluation activities. Some county governments are exploring the possibility of contributing to the public financial support to premiums to match that which is currently provided by the national government.

- national government (planners, decision-makers)

The government of Kenya, the State Department of Livestock (SDL) under the Ministry of Agriculture Livestock and Fisheries

The GoK purchases KLIP policies on behalf of the pastoralists targeted under the KLIP program.

- international organization

Development partners such as the World Bank and ILRI

The World Bank Group provides KLIP funding to the GoK and is the principal technical adviser to SDL on KLIP. ILRI is responsible for providing technical assistance to SDL on all issues relating to insurance product design, management and improvement, as well as training and awareness creation. ILRI’s contributions are based on their experience developing, implementing and assessing an Index-Based Livestock Insurance (IBLI) program since 2008 (http://ibli.ilri.org/).

3.2 Involvement of local land users/ local communities in the different phases of the Approach

| Involvement of local land users/ local communities | Specify who was involved and describe activities | |

|---|---|---|

| initiation/ motivation | interactive | GoK was motivated to implement KLIP in order to protect vulnerable communities from livestock losses due to drought, and also accelerate further uptake of livestock insurance by pastoralists, by experiencing how the product works. |

| planning | interactive | KLIP exemplifies the case of a multi-stakeholder participatory approach linking scientific analysis with local knowledge, while facilitating the awareness, understanding and acceptance of the product by local communities. Activities such as; delineation of geographic areas that constitute an insurable unit and selection of KLIP beneficiaries are conducted through transparent and participatory means. |

| implementation | interactive | KLIP is implemented by the SDL with support from World Bank and ILRI in collaboration with local private insurance companies which underwrite the product either individually or as a consortium. County governments and local NGOs are also involved in the implementation of KLIP. |

| monitoring/ evaluation | interactive | M & E under KLIP, largely relies on acquiring information from management and project records that reflect program resource use and implementation. Primary data collection from key stakeholders is also used. Outcome measurement uses a combination of both qualitative and quantitative methods. Data collection for high level outcomes, for instance the impact of KLIP on household welfare, will require the use of official country level data or relying on countrywide surveys, since these outcomes are normally outside the full control of the program. |

| interactive |

3.3 Flow chart (if available)

Description:

KLIP beneficiaries are pastoralist households whose livelihoods are highly dependent on livestock and are susceptible to climate uncertainties and recurrent droughts. They are considered to have limited alternative sources of livelihoods and any disruptions to livestock assets lead to destitution. The beneficiaries are selected through participatory community meetings convened by local chiefs and opinion leaders with the support of county government agricultural extension officers. The main criteria for selection is that each household must own less than 5 Tropical Livestock Units (TLU), which is approximately 5 cows (1TLU = 1 cow).

A calculating agent is an independent company or organization responsible for: (i) accessing eModis NDVI data during the Cover Period and (ii) for processing this data to calculate the index value in accordance with the agreed methodology for each Insured Unit in each county during the cover period and (iii) for reporting this data to the Insurer and the Insured on a timely basis.

Once the index is triggered, the calculating agent notifies the insurance company and the SDL. Cash pay-outs are prepared by the insurance company and disbursed to the registered beneficiary households through mobile money transfers e.g. M-Pesa (available in Kenya), bank transfers and cheques.

Author:

Duncan C. Khalai

3.4 Decision-making on the selection of SLM Technology/ Technologies

Specify who decided on the selection of the Technology/ Technologies to be implemented:

- all relevant actors, as part of a participatory approach

Specify on what basis decisions were made:

- evaluation of well-documented SLM knowledge (evidence-based decision-making)

4. Technical support, capacity building, and knowledge management

4.1 Capacity building/ training

Was training provided to land users/ other stakeholders?

Yes

Specify who was trained:

- land users

- field staff/ advisers

Form of training:

- farmer-to-farmer

- public meetings

- courses

Subjects covered:

1. Introduction to KLIP and its key features

a. Contract features

b. KLIP coverage

2. Beneficiary selection & registration

3. KLIP communication and awareness creation – Managing interactions with other programs

4. KLIP Voluntary and fully subsidized products - features and differences

5. County governments and State Department of Livestock coordination

Comments:

A general training course, whose content elaborates how index based livestock insurance works was developed and distributed in form of an e-learning platform available fro registration at http://learning.ilri.org. The same course is also available in form of physical manuals and simplified pictorial books.

4.2 Advisory service

Do land users have access to an advisory service?

Yes

Specify whether advisory service is provided:

- at permanent centres

Describe/ comments:

A Program Coordination Unit (PCU) comprising of a program coordinator and 2 technical officers i.e. an M&E specialist and a Networking and Capacity development specialist were constituted under the SDL. The PCU is responsible for implementing the program and its day-to-day operations. Each technical officer is responsible for specific components of the program. Advisory communication via phone and email are frequently conducted between the KLIP implementation counties and the PCU. The PCU also supports recruitment of beneficiaries, training, awareness, M&E and communication for KLIP beneficiaries, various stakeholders and partners. ILRI provides support to these activities through its Markets and Capacity development unit. The PCU also provides reports to county governments on all KLIP related aspects including; the status of the index, number and identity of beneficiaries and the amount of indemnities paid.

4.3 Institution strengthening (organizational development)

Have institutions been established or strengthened through the Approach?

- yes, moderately

Specify the level(s) at which institutions have been strengthened or established:

- local

- regional

- national

Describe institution, roles and responsibilities, members, etc.

At the National level; the KLIP coordination unit under the Ministry of Agriculture, Livestock and Fisheries is responsible for the following:

-To develop, and institutionalize a large-scale sustainable livestock insurance program for the Arid and Semi-Arid Lands

-Efficient and effective engagement of relevant stakeholders

-Influencing policy

-Develop and maintain Public Private Partnerships

-To institutionalizing provision of livestock insurance at national and county government levels for increased resilience of vulnerable pastoralists

-Sustained demand of livestock insurance

Regional governments (Counties) are responsible for the following:

- Support access to appropriate livestock insurance products - registration of beneficiaries, extension and awareness creation

International NGOs i.e. The World Bank Group (WBG) provides funding to the GoK and is also the principal technical adviser to the SDL on KLIP. ILRI is also funded by the World Bank Group to provide technical support around KLIP contract design, awareness creation and capacity development.

Specify type of support:

- financial

- capacity building/ training

4.4 Monitoring and evaluation

Is monitoring and evaluation part of the Approach?

Yes

Comments:

A monitoring and evaluation framework is in place to ensure that the program is constantly improved and that it can respond to challenges and opportunities arising in the field. The M&E framework is a tool for continuous program planning, implementation and reflection and also used for day-to-day reporting and tracking of progress towards outcomes and long-term impacts. The M&E frameworks's principle purposes are summarized as follows: • Tracking progress on program implementation • Identifying gaps and weaknesses in the implementation process • Planning, prioritizing, allocating and managing resources during the entire program timeline • Providing lessons for program management Regular technical reports are generated by the PCU to be submitted to the KLIP technical committee for their technical inputs.

If yes, is this documentation intended to be used for monitoring and evaluation?

No

Comments:

KLIP M&E frame work is available

4.5 Research

Was research part of the Approach?

Yes

Specify topics:

- sociology

- economics / marketing

- technology

Give further details and indicate who did the research:

A livestock insurance service for Kenya's ASALs was tested with remarkable success on a pilot basis by the International Livestock Research Institute (ILRI's) Index Based Livestock Insurance (IBLI) from 2010 –2015 supported by DfID, AUSAID, USAID and other development partners. The lessons drawn from this experience were incorporated in the inception and implementation of KLIP.

5. Financing and external material support

5.1 Annual budget for the SLM component of the Approach

If precise annual budget is not known, indicate range:

- > 1,000,000

Comments (e.g. main sources of funding/ major donors):

The main source of funding for the KLIP project is from the government of Kenya and the World Bank.

5.2 Financial/ material support provided to land users

Did land users receive financial/ material support for implementing the Technology/ Technologies?

Yes

If yes, specify type(s) of support, conditions, and provider(s):

Over 14,000 households currently under KLIP receive fully subsidized livestock insurance cover where the government of Kenya fully funds the premiums at an average rate of Ksh. 3000 per TLU, based on the cost of feeding 1 TLU during the months affected with severe drought during in a year. Each pastoralist receives cover for a maximum of 5 cows (5 TLU).

However the SDL plans to provide for a partially subsidized KLIP cover, which can be purchased by any interested pastoralist, for as long as they are willing to pay for a partial cost of the premium . Further considerations are underway to assess the possibility of making voluntary insurance more accessible and affordable to pastoralists by partial premium subsidies.

5.3 Subsidies for specific inputs (including labour)

- agricultural

| Specify which inputs were subsidised | To which extent | Specify subsidies |

|---|---|---|

| Insurance Premiums | fully financed | The government pays premiums on behalf of the pastoralists but is the policy holder. However, in-case a payout is triggered, the pastoralists receive the indemnity directly. Over time, the GoK plans to reduce the size of public support by transitioning into voluntary type of insurance. |

5.4 Credit

Was credit provided under the Approach for SLM activities?

No

5.5 Other incentives or instruments

Were other incentives or instruments used to promote implementation of SLM Technologies?

Yes

6. Impact analysis and concluding statements

6.1 Impacts of the Approach

Did the Approach empower local land users, improve stakeholder participation?

- No

- Yes, little

- Yes, moderately

- Yes, greatly

KLIP has facilitated regular stakeholder interactions leveraging various partnerships forged within its PPP framework. Local communities, county governments, national government and NGOs are all engaged in the quest to find solutions for the pastoralists, who face repetitive cycles of devastating droughts.

Did the Approach enable evidence-based decision-making?

- No

- Yes, little

- Yes, moderately

- Yes, greatly

KLIP has largely enabled evidence-based decision making within the National treasury and Parliament as both entities have been considerably increasing annual financial allocations for KLIP. Other donors e.g. the World Bank continue to support KLIP implementation as well as there being increased interest from county governments to provide additional funding towards the program. Also more pastoralists are beginning to voluntarily purchase livestock insurance as they have experienced ho the product works through KLIP.

Did the Approach help land users to implement and maintain SLM Technologies?

- No

- Yes, little

- Yes, moderately

- Yes, greatly

The impact of KLIP on the target population with regards to land use and maintenance of SLM technologies is not yet observable as KLIP is only 3 years into implementation. Rigorous impact analysis may need to be conducted to establish such impacts. However, the rising demand for the KLIP product both from the insurance companies (supply side) and the pastoralists (demand side) is an indication of implementation and maintainance of the SLM (KLIP).

Did the Approach mobilize/ improve access to financial resources for SLM implementation?

- No

- Yes, little

- Yes, moderately

- Yes, greatly

Advocacy efforts have been directed at raising decision makers’ awareness on the benefits of KLIP is having and the potential it holds for pastoralist communities country-wide. County governments and donors need to appreciate and be motivated towards playing a key role in the implementation KLIP.

Did the Approach improve knowledge and capacities of land users to implement SLM?

- No

- Yes, little

- Yes, moderately

- Yes, greatly

Insurance as a concept is complex and regulated entities in the sector seldom commit resources for awareness creation other than marketing of their individual products. KLIP implementation takes into account this situation and has continuously undertaken publicity and awareness creation about insurance with the aim of ensuring that consumers know about and understand the concept of insurance, and can make informed judgments and to take effective decisions in an insurance transaction.

Did the Approach improve knowledge and capacities of other stakeholders?

- No

- Yes, little

- Yes, moderately

- Yes, greatly

KLIP implementation has capacity development as one of its key components, which entails developing tools and materials that help support training, extension and awareness creation on KLIP's agenda. Various government, Insurance, County and Community members have undergone KLIP training at distinct levels. Despite all this, there is still room for more to be achieved with regards to capacity development.

Did the Approach build/ strengthen institutions, collaboration between stakeholders?

- No

- Yes, little

- Yes, moderately

- Yes, greatly

Since its inception in 2014, KLIP has thrived on collaboration among various state and non-state actors. The State Department of World Bank Group, the International Livestock Research Institute (ILRI) and the Financial Sector Deepening Kenya (FSD), private local insurers (APA Insurance Ltd., UAP Insurance, CIC Insurance, Jubilee Insurance, Amaco Insurance, Heritage Insurance, Kenya Orient) and one global reinsurer (Swiss Re)).

Did the Approach empower socially and economically disadvantaged groups?

- No

- Yes, little

- Yes, moderately

- Yes, greatly

ILRI conducted a phone survey in 2017, where 643 phone numbers registered to beneficiaries under the KLIP program were selected out of the total 14,000 beneficiaries. Out of the 643, 337 beneficiaries were reached and out of these 300 were surveyed (37 either had no time or did not consent). Questions were asked about the Short Rain Short Dry 2016 and Long Rain Long Dry 2017 seasons. Of the 300 surveyed, 129 reported receiving KLIP payments associated with the SRSD 2016 drought. Out of these 58% indicated having spent the money on food. Based on this therefore, it can be noted that KLIP has moderately contributed to social and economic empowerment of disadvantaged groups.

xxxxx

Did the Approach lead to improved food security/ improved nutrition?

- No

- Yes, little

- Yes, moderately

- Yes, greatly

Under the same study described above, out of 300 beneficiaries surveyed, 129 reported receiving KLIP payments associated with the SRSD 2016 drought, 75 (58%) of these, reported having spent the cash on food stuff for their households.

The KLIP study above also indicated increased access to markets as respondents were asked how they changed their response to the drought once they knew that the KLIP payouts were coming. Out of the 63 respondents to this question, more than 50% indicated that they increased purchase of, veterinary drugs & services together with forage and water for their animals.

There is no evidence linking sustainable use of energy to KLIP

Did the Approach improve the capacity of the land users to adapt to climate changes/ extremes and mitigate climate related disasters?

- No

- Yes, little

- Yes, moderately

- Yes, greatly

KLIP has so far been able to enhance the capacity of pastoral communities to minimize weather related risks through provision of index based livestock insurance build the resilience of vulnerable pastoralists in Kenya's ASALs.

6.2 Main motivation of land users to implement SLM

- reduced risk of disasters

A large-scale livestock insurance program could help to protect core breeding herd assets thereby building drought resilience and contributing to improved livelihoods and incomes for the pastoralists.

- payments/ subsidies

KLIP implementation is organized in two key payment/ subsidy based components that are being implemented in a phased approach:

Fully subsidized KLIP: Under this component, the GoK purchases index insurance on behalf of selected vulnerable pastoralists in the ASALs. GoK pays the premiums for up to 5 TLU for only the selected households. Over time, the government plans to reduce the size of public support through the provision of a partially subsidized cover. Under this approach, any household, whether beneficiary of the fully supported KLIP or not, shall have the opportunity to purchase index insurance at market rates. Eventually the government hopes to achieve higher uptake of index based livestock insurance by pastoralists on a commercial basis.

- enhanced SLM knowledge and skills

Extension services, distribution of KLIP awareness materials, radio programs, workshops and structured community engagements are part of the SDL and partners' efforts to enhance knowledge and skills on KLIP.

6.3 Sustainability of Approach activities

Can the land users sustain what has been implemented through the Approach (without external support)?

- uncertain

If no or uncertain, specify and comment:

KLIP is structured in a double pronged approach meant to ensure scale up and sustainability, however uncertainty over the program's sustainability emanates from the lack of government policies that can guarantee continuity. Efforts are still ongoing to ensure such policies are in place.

6.4 Strengths/ advantages of the Approach

| Strengths/ advantages/ opportunities in the land user’s view |

|---|

| High level support from the government and development partners is a strength for KLIP as it continues to attract goodwill from key stakeholders within and outside government. |

| KLIP is anchored in a reliable, simple and trusted technology - index based livestock insurance, which is a product of rigorous research. |

| KLIP's impacts and lessons are replicable and scalable in other geographical locations . |

6.5 Weaknesses/ disadvantages of the Approach and ways of overcoming them

| Weaknesses/ disadvantages/ risks in the land user’s view | How can they be overcome? |

|---|---|

| Full commercialization of livestock insurance might be a challenge to achieve considering that the private sector, especially insurance companies are profit oriented and might not be fully motivated to venture into the hard to reach, remote and poorly infrastructured ASALs of Kenya where KLIP is implemented. | Continuous capacity development and proper policy environment should be created to enable the private sector's desire to venture into the target regions and fully commercialize the product. |

| Sustainability – There is no government policy or legislative Act on KLIP . Its therefore not a guaranteed possibility that the government will support this in the long term. | Continued advocacy, lobbying and sensitization need to be done targeting the key policy makers. Also a proper exit strategy should be designed and put into action. |

7. References and links

7.1 Methods/ sources of information

- compilation from reports and other existing documentation

7.2 References to available publications

Title, author, year, ISBN:

N/A

7.3 Links to relevant information which is available online

Title/ description:

Successful Kenya Livestock Insurance Program scheme scales up

URL:

http://www.swissre.com/reinsurance/successful_Kenya_livestock_insurance_program_scheme_scales_up.html

Title/ description:

Govt to release record cash payout in livestock insurance program

URL:

https://www.capitalfm.co.ke/business/2017/03/govt-to-release-record-cash-payout-in-livestock-insurance-program/

Title/ description:

APA Pay The First Major Claim To The Kenya Livestock Insurance Program (KLIP) Farmers

URL:

http://www.apainsurance.org/news/apa-pay-the-first-major-claim-to-the-kenya-livestock-insurance-program-klip-farmers/

Title/ description:

SATELLITE, MOBILE TECHNOLOGIES UNDERPIN INSURANCE PAYOUT TO HERDERS IN KENYA

URL:

https://www.iii.org/insuranceindustryblog/?tag=kenya-livestock-insurance-program

Title/ description:

Record payouts being made by Kenya Government and insurers to protect herders facing historic drought

URL:

https://ibli.ilri.org/2017/02/22/record-payouts-being-made-by-kenya-government-and-insurers-to-protect-herders-facing-historic-drought/

Links and modules

Expand all Collapse allLinks

No links

Modules

No modules